All Categories

Featured

If you're mosting likely to make use of a small-cap index like the Russell 2000, you could want to stop and think about why a great index fund business, like Vanguard, does not have any type of funds that follow it. The factor is since it's a lousy index. As well as that changing your entire policy from one index to one more is barely what I would certainly call "rebalancing - growth life insurance." Cash worth life insurance policy isn't an appealing asset class.

I have not also dealt with the straw guy here yet, and that is the reality that it is reasonably rare that you actually have to pay either taxes or significant compensations to rebalance anyhow. I never have. Many intelligent capitalists rebalance as high as feasible in their tax-protected accounts. If that isn't rather adequate, very early accumulators can rebalance totally utilizing new payments.

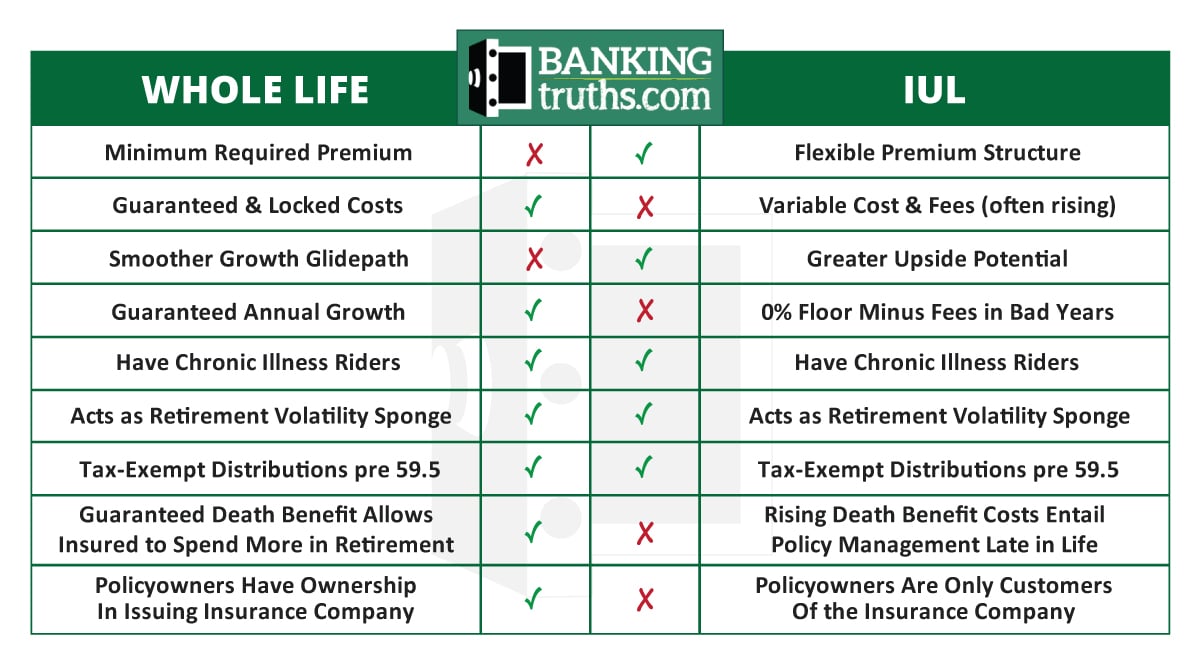

Iul Tax Free Retirement

And of course, no one needs to be buying packed mutual funds, ever before. It's actually also bad that IULs don't function.

Latest Posts

Universal Life Insurance Rate

Universal Life Insurance For Business Owners

Guaranteed Universal Life Policy