All Categories

Featured

Table of Contents

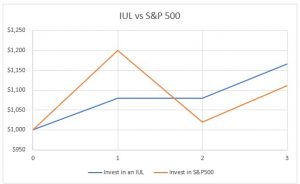

Do they compare the IUL to something like the Vanguard Total Supply Market Fund Admiral Shares with no lots, a cost ratio (EMERGENCY ROOM) of 5 basis factors, a turnover proportion of 4.3%, and an extraordinary tax-efficient record of distributions? No, they compare it to some awful proactively handled fund with an 8% tons, a 2% ER, an 80% turn over proportion, and a dreadful document of short-term resources gain distributions.

Common funds often make yearly taxable circulations to fund proprietors, also when the worth of their fund has actually gone down in value. Mutual funds not only require earnings coverage (and the resulting yearly taxes) when the mutual fund is increasing in value, but can also impose revenue taxes in a year when the fund has dropped in worth.

You can tax-manage the fund, harvesting losses and gains in order to decrease taxable circulations to the financiers, but that isn't in some way going to change the reported return of the fund. The possession of common funds may require the common fund proprietor to pay estimated tax obligations (no lapse universal life insurance).

IULs are simple to position so that, at the proprietor's fatality, the recipient is exempt to either earnings or estate taxes. The same tax decrease techniques do not function almost also with shared funds. There are countless, typically costly, tax obligation traps connected with the timed trading of shared fund shares, traps that do not apply to indexed life insurance policy.

Opportunities aren't really high that you're mosting likely to undergo the AMT as a result of your shared fund circulations if you aren't without them. The rest of this one is half-truths at ideal. For circumstances, while it is true that there is no income tax due to your successors when they inherit the profits of your IUL policy, it is likewise real that there is no income tax because of your heirs when they acquire a shared fund in a taxed account from you.

History Of Universal Life Insurance

There are much better ways to stay clear of estate tax problems than getting investments with reduced returns. Shared funds may cause earnings taxes of Social Safety and security advantages.

The growth within the IUL is tax-deferred and may be taken as tax complimentary income via financings. The policy owner (vs. the mutual fund supervisor) is in control of his/her reportable revenue, hence enabling them to lower or even eliminate the tax of their Social Safety and security benefits. This set is wonderful.

Here's an additional minimal problem. It holds true if you acquire a common fund for state $10 per share prior to the distribution date, and it disperses a $0.50 circulation, you are then mosting likely to owe tax obligations (probably 7-10 cents per share) although that you have not yet had any gains.

In the end, it's actually regarding the after-tax return, not just how much you pay in taxes. You are mosting likely to pay more in tax obligations by utilizing a taxable account than if you acquire life insurance policy. Yet you're also probably going to have more money after paying those taxes. The record-keeping needs for having shared funds are substantially more complicated.

With an IUL, one's documents are kept by the insurance provider, duplicates of annual statements are mailed to the proprietor, and distributions (if any kind of) are totaled and reported at year end. This one is also kind of silly. Naturally you ought to keep your tax obligation documents in instance of an audit.

Indexed Universal Life Insurance Vs Term

Rarely a factor to purchase life insurance. Common funds are frequently component of a decedent's probated estate.

On top of that, they are subject to the delays and expenses of probate. The proceeds of the IUL plan, on the various other hand, is constantly a non-probate distribution that passes beyond probate straight to one's named beneficiaries, and is therefore not subject to one's posthumous creditors, unwanted public disclosure, or similar delays and expenses.

Medicaid incompetency and lifetime income. An IUL can supply their owners with a stream of earnings for their whole life time, regardless of just how lengthy they live.

This is valuable when arranging one's events, and transforming assets to income before an assisted living facility arrest. Shared funds can not be transformed in a similar fashion, and are generally taken into consideration countable Medicaid properties. This is an additional silly one advocating that poor people (you recognize, the ones that require Medicaid, a government program for the inadequate, to pay for their retirement home) should use IUL instead of common funds.

Net Payment Cost Index Life Insurance

And life insurance policy looks awful when compared rather versus a retirement account. Second, people that have money to acquire IUL over and past their pension are mosting likely to need to be awful at handling cash in order to ever receive Medicaid to spend for their nursing home prices.

Chronic and incurable ailment rider. All policies will certainly allow an owner's very easy accessibility to cash from their policy, often forgoing any kind of surrender penalties when such individuals experience a significant illness, need at-home treatment, or come to be restricted to an assisted living facility. Mutual funds do not provide a comparable waiver when contingent deferred sales charges still use to a common fund account whose proprietor needs to sell some shares to money the expenses of such a stay.

What Is Indexed Universal Life Insurance

You obtain to pay more for that benefit (biker) with an insurance coverage policy. Indexed global life insurance coverage supplies fatality advantages to the recipients of the IUL owners, and neither the proprietor neither the beneficiary can ever before lose money due to a down market.

I absolutely do not need one after I reach monetary self-reliance. Do I desire one? On average, a buyer of life insurance coverage pays for the real expense of the life insurance policy benefit, plus the prices of the policy, plus the profits of the insurance coverage business.

Universal Life Insurance As A Retirement Plan

I'm not entirely sure why Mr. Morais included the whole "you can not shed cash" again here as it was covered rather well in # 1. He simply wished to repeat the ideal marketing point for these things I intend. Once again, you don't lose nominal dollars, but you can lose real bucks, as well as face significant chance expense because of reduced returns.

An indexed global life insurance policy policy owner may trade their policy for a totally various plan without triggering revenue taxes. A shared fund owner can not relocate funds from one shared fund firm to another without offering his shares at the previous (therefore activating a taxable occasion), and buying new shares at the last, often based on sales charges at both.

While it holds true that you can exchange one insurance coverage policy for one more, the reason that individuals do this is that the first one is such an awful policy that even after acquiring a brand-new one and experiencing the very early, adverse return years, you'll still appear ahead. If they were sold the appropriate policy the first time, they should not have any desire to ever trade it and undergo the very early, adverse return years once again.

Latest Posts

Universal Life Insurance Rate

Universal Life Insurance For Business Owners

Guaranteed Universal Life Policy